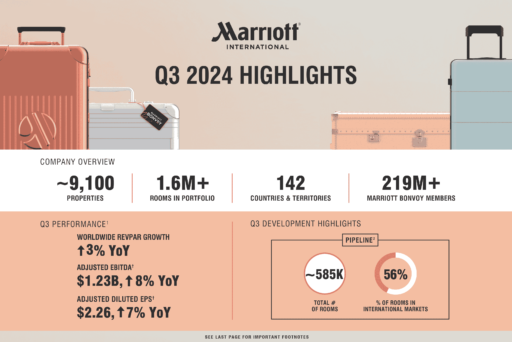

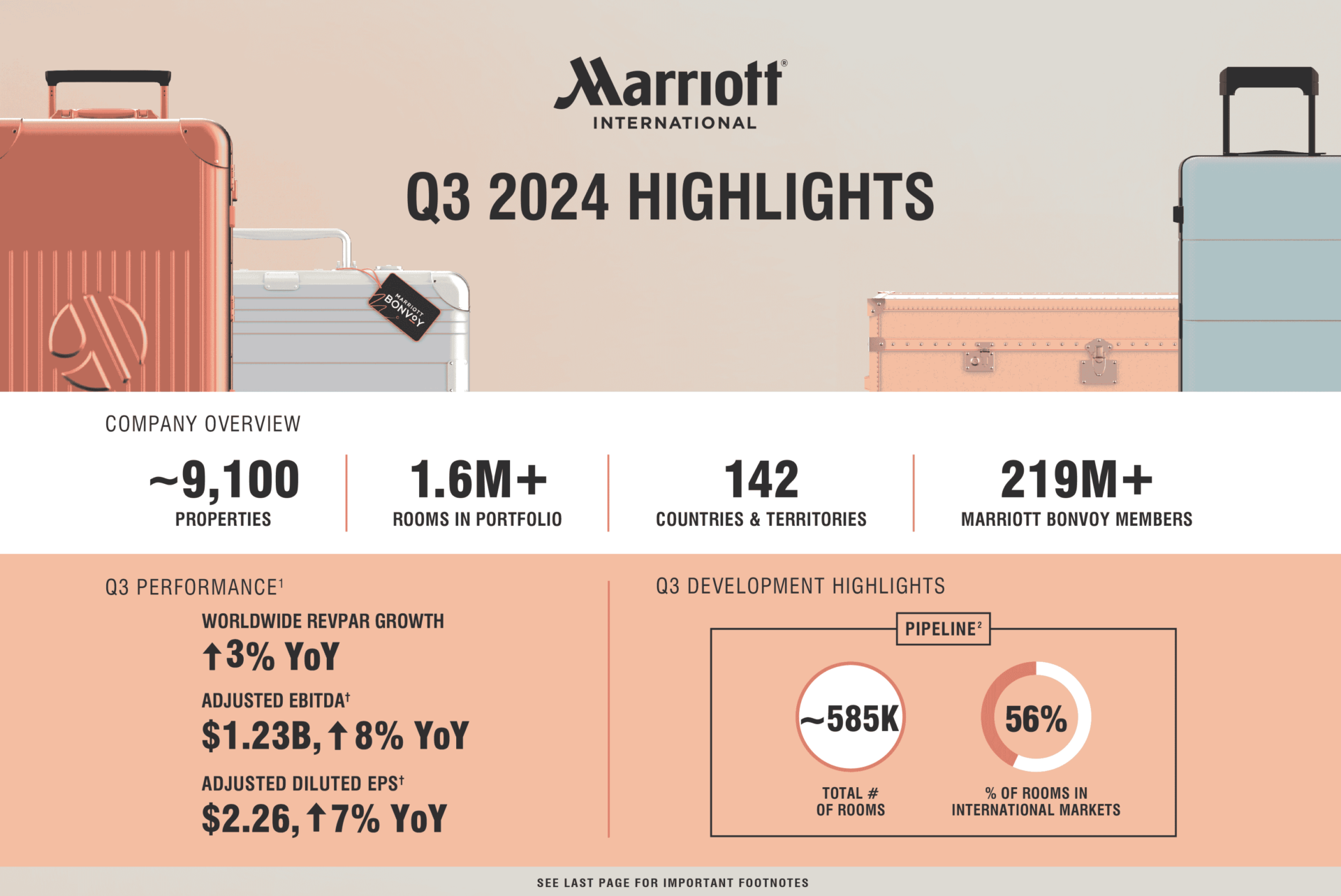

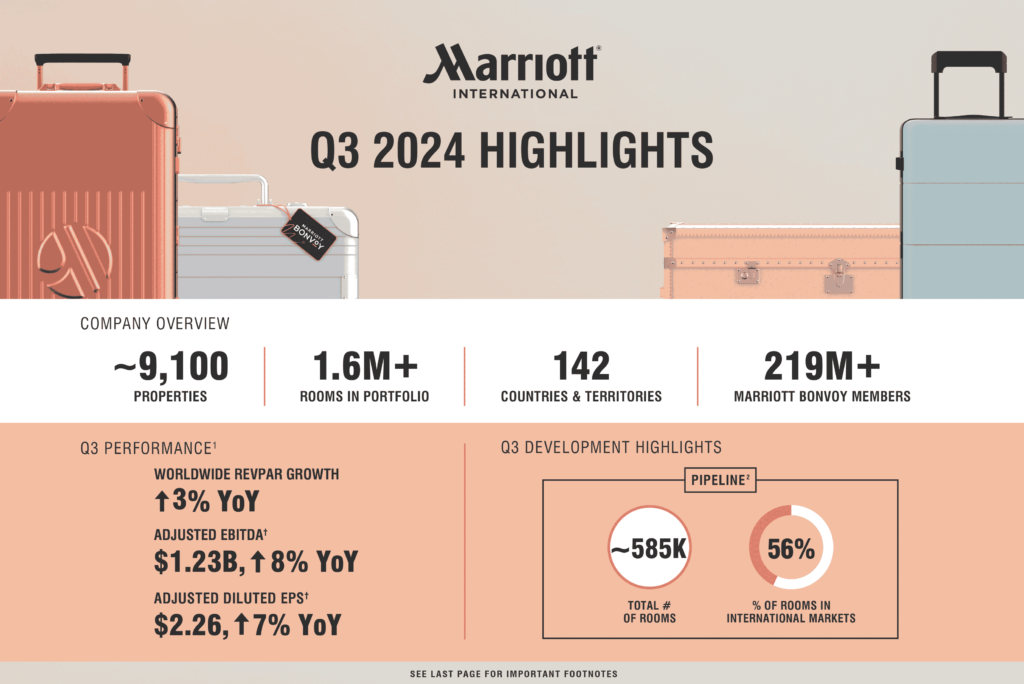

Marriott International reported strong third quarter 2024 results, highlighted by a 3.0% year-over-year increase in global RevPAR, with international markets seeing a 5.4% rise. U.S. & Canada RevPAR increased by 2.1%.

Marriott’s adjusted net income reached $638 million, up slightly from $634 million in Q3 2023, while adjusted EBITDA hit $1.229 billion, reflecting solid growth from last year’s $1.142 billion.

CEO Anthony Capuano attributed the positive results to strong net room additions, robust demand for Marriott’s brands, and a notable 10% increase in global group RevPAR.

READ MORE: Experience Winter Wonderland at Four Seasons Hotel Silicon Valley’s Après Village

Business transient RevPAR also grew, while leisure transient RevPAR remained steady but above pre-pandemic levels. Capuano noted that Marriott’s record-breaking pipeline of 585,000 rooms, with a significant portion under construction, supports a projected net room growth of 6.5% for 2024.

Marriott expanded its global footprint with 16,000 new rooms in Q3, bringing its total portfolio to nearly 9,100 properties and 1.675 million rooms worldwide. Over 40% of the 95,000 rooms signed in 2024 to date were conversions, with strong international interest.

The company returned approximately $4.4 billion to shareholders in 2024 through dividends and share repurchases, with $1 billion spent repurchasing 4.5 million shares in Q3 alone. Marriott also issued $1.5 billion in senior notes during the quarter to strengthen its financial standing.

Looking ahead, Marriott anticipates cost savings of $80 to $90 million annually beginning in 2025 through efficiency initiatives aimed at benefiting both the company and its franchisees.

READ MORE: Four Seasons Hotel Tunis Presents: A Mediterranean Journey – Discover the Flavors of Sicily